does idaho tax pensions and social security

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

Tax Withholding For Pensions And Social Security Sensible Money

Hawaii does not tax Social Security benefits.

. Even though the pension income is from an Idaho source federal law prevents Idaho from taxing it. The state allows a subtraction from benefits ranging from 2645 for married taxpayers who file separately to 4130 for single taxpayers to 5290 for married taxpayers who file jointly. Minnesota 33 of Benefits Missouri Based on Annual Income Amount Montana.

For income that is taxed the lowest Hawaii tax rate is 14 on taxable income up to 4800 for joint filers and up to 2400 for single filers. Exceptions include Canadian Social Security benefits OAS QPP and. Does federal government tax Social Security.

52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. According to Retirement Living Information Center States that exempt pension income entirely for qualified retirees are Alaska Florida Illinois. 800-972-7660 or taxidahogov Retirement Benefits exclusion.

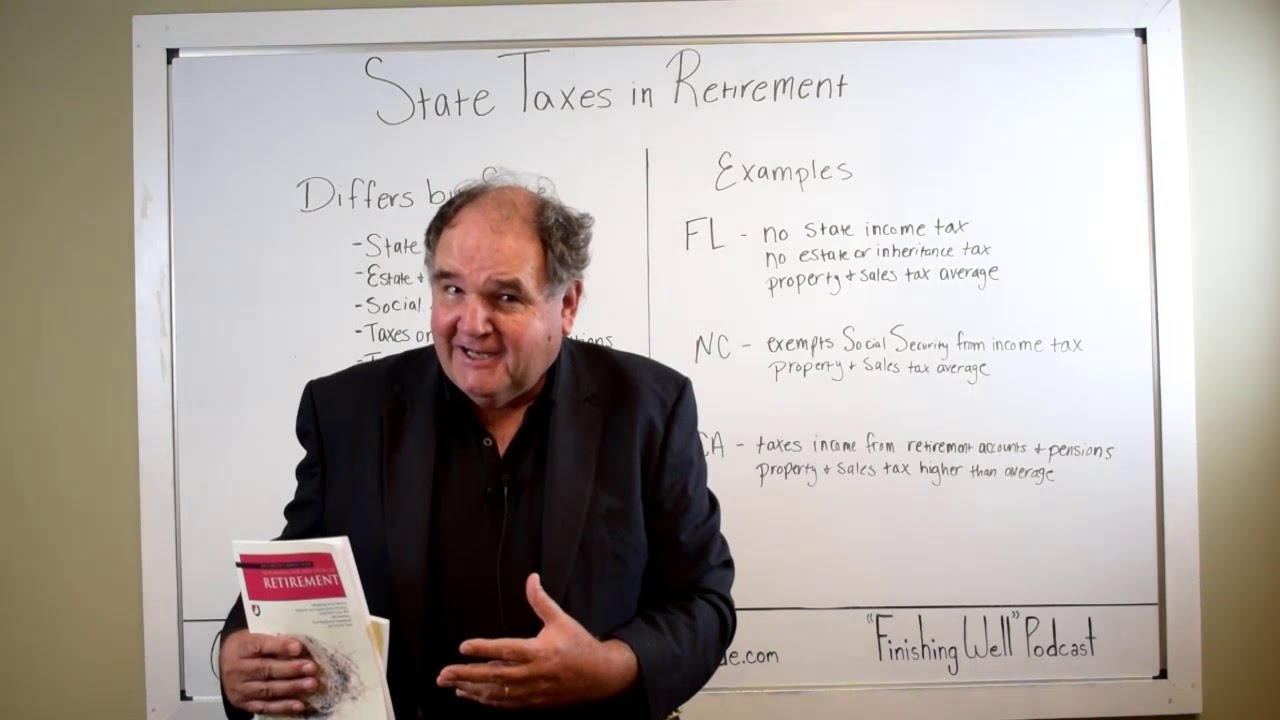

That means the state does not tax Social Security benefits pension income 401k plan withdrawals and IRA distributions or other income. Nine of the 13 states in the West dont have income taxes on Social Security. Likewise people ask what states do not tax your pension or Social Security.

Alaska Nevada Washington and Wyoming dont have state income taxes at all and Arizona California Hawaii Idaho and Oregon have special provisions exempting Social Security benefits from state taxation. Does idaho tax social security. For more information see the Hawaii State Tax Guide for Retirees.

Part 1 Age Disability and Filing status. Idaho is tax-friendly toward retirees. If Sam does not want taxes withheld from his pension instead he could make quarterly tax payments of 647 on April 15 June 15 September 15 of the 2020 tax year and January 15 of the following year.

Hawaii does not tax Social Security benefits. Up to 85 of Social Security benefits are taxable for an individual with a combined gross income of at least 34000 or a couple filing jointly with a combined gross income of at least. We have guides to help you learn more about Idaho Residency Status and Idaho Source Income.

While potentially taxable on your federal return these arent taxable in Idaho. Connecticut 50 of Benefits Florida no state taxes Kansas. Pension from out-of-Idaho job now moved to Idaho.

Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits. She became a resident of California and receives pension income from a job she had in Idaho. The following states are exempt from income taxes on Social Security Benefits.

The rule is subject to phaseouts starting at incomes of 80270 for joint married filers. Now that they are collecting Social Security the tax calculation requires an extra step. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

Minnesota partially taxes Social Security benefits. That leaves Colorado Montana New Mexico and Utah. Does Hawaii tax Social Security.

My wife and I are in our 50s with 300000 in a 401. Some states with low or no income taxes have higher property or sales taxes. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans.

The 20 Worst Places to Live in Idaho Post Does Idaho tax Social Security. Most pension benefits are currently taxable on your Idaho state income tax return. Now that they are collecting Social Security the tax calculation requires an extra step.

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Taxes And Economic Factors To Consider

How Every State Taxes Differently In Retirement Cardinal Guide

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

37 States That Don T Tax Social Security Benefits The Motley Fool

Tax Withholding For Pensions And Social Security Sensible Money

Is Social Security Income Taxable

All The States That Don T Tax Social Security Gobankingrates

Tax Withholding For Pensions And Social Security Sensible Money

Taxes 1099 R Public Employee Retirement System Of Idaho

How Every State Taxes Differently In Retirement Cardinal Guide

37 States That Don T Tax Social Security Benefits The Motley Fool

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

37 States That Don T Tax Social Security Benefits The Motley Fool

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Retiring These States Won T Tax Your Distributions

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group