lake county real estate taxes covid 19

We perform a vital service for Lake Countys government and residents and Im honored to serve as your Treasurer. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

Chenango County Real Property Tax Services Assesment And Tax Rolls

July 15 2021 at 622 am.

. Lake County IL 18 N County Street Waukegan IL. See how your individual property taxes are distributed for any parcel and how to contact those taxing bodies on Lake Countys Tax Distribution website. Ill be making sure the office carries out its required duties and becomes a place where Lake County residents can get answers.

The assessors offices are working in the 2021. Can the Tax Collector extend the April 10 2020 deadline. Coronavirus COVID-19 Impact to Property Taxes.

Current Real Estate Tax. Lake County Treasurer Lorraine Fende and Lake County Auditor Christopher Galloway announced this week the process for. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Lake County Jobs. The Lake County Board appears unlikely to postpone deadlines for property tax payments or waive late fees this year because of the COVID-19 pandemic.

The County Board decided against delaying the collection of taxes or waiving. LAKE COUNTY Lake County property owners must still pay their property taxes despite coronavirus restrictions but some can expect more leeway on late fees. On March 31 2020 the County of Lake Tax Collector published a Frequently Asked Questions document.

Return to Work - Worksite Prevention Protocol. Return to Work - Worksite Prevention Protocol. Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. May 13 2020 1121 AM 9 min read. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

9 AM to 430 PM Levy for collection of taxes must be filed with our office on or before the last Tuesday in December in each year. The Federal Government has provided Coronavirus Local Fiscal Recovery Funds Recovery Funds through the American Rescue Plan Act ARPA to provide relief to local governmental units as a result of the COVID-19 Pandemic. April 8 2020 at 600 am.

What if I am unable to make a full property tax payment by April 10 2020 due to the impact of COVID-19. View maps of different taxing districts in Lake Countys Tax District Map Gallery. Change My Tax Bill Mailing Address Request Child Support Payment History Confirm My Jury Duty Summons File For Property Tax Deduction Get a Copy of Birth or Death Certificate Get a Copy of Marriage License Apply for Building Permit Online Reserve.

The Board of Supervisors is aware many residents have questions regarding how Property Tax payments will proceed in light of the COVID-19 crisis. SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID. Given the significant interest as a service.

The County does not have the authority under State law to extend or postpone the second installment property tax deadline of April. Property Assessments are conducted when. Check out your options for paying your property tax bill.

Treasury Department the Treasury Department awarded. In response to COVID-19 the Lake County Clerks Tax Extension and Redemption Department is open on weekdays as follows. In response to COVID-19 the Lake County Clerks Tax Extension and Redemption Department is open on weekdays as follows.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Half Of Property Tax Payments Deferred By 60 Days In Lake County The Lake County Board voted to allow taxpayers to divide their property tax bills into four installments because of the COVID-19. It is typical to have to pay property taxes in two annual installments May 10 and November 10 each year in arrears and is typically due in October and April.

Pay online at httptaxlakecountycagov or by telephone 866 506-8035 There is a convenience fee of 25 for creditdebit card payments or a 300 flat fee for an e-Check. In response to the COVID-19 pandemic certain Illinois counties including Cook County DuPage County Lake County Will County Kane County and McHenry County are offering property tax relief for real property taxpayers. Maps Records Transparency.

Instead of the usual two installments taxpayers will be able to spread their payments over four installments. Indiana residents can pay their May property tax installment until July 10 without penalty this year in response to the COVID-19 pandemic and. Lake County Indiana - 2021 Recovery Plan Performance Report.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Lake County property owners will receive their property tax bills as scheduled and be expected to pay them by June 8. June 19 2020 at 1000 am.

Homeowners in Lake County and across Illinois who are behind in paying their mortgages and in some cases property taxes because of the coronavirus pandemic will soon have a new opportunity. Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021. Protecting the Public and Our Employees.

Return to Work - Worksite Prevention Protocol. Get important health information and updates for Lake County residents. Protecting the Public and Our Employees.

Notice Of Real Estate Tax Due Dates. Mick Zawislak Follow dhMickZawislak. WAUKEGAN IL A divided Lake County board voted Tuesday to extend property tax deferrals to all taxpayers rather than limiting the relief to operators of non-essential businesses and some qualifying laid-off employees.

We encourage all property owners who can pay their taxes on time to do so. Are Indiana Property Taxes Paid In Advance Or Arrears. Depending on the county the taxpayer may be required to establish financial hardship to receive relief.

Covid 19 Protection Risks Responses Situation Report No 7 As Of 24 August 2020 Global Protection Cluster

Mobility Under The Covid 19 Pandemic Asymmetric Effects Across Gender And Age In Imf Working Papers Volume 2020 Issue 282 2020

Foreign Real Estate Now Also Taxed On The Basis Of Cadastral Income Loyens Loeff

Why Has Peru Been So Badly Hit By Covid 19 Devpolicy Blog From The Development Policy Centre

Mobility Under The Covid 19 Pandemic Asymmetric Effects Across Gender And Age In Imf Working Papers Volume 2020 Issue 282 2020

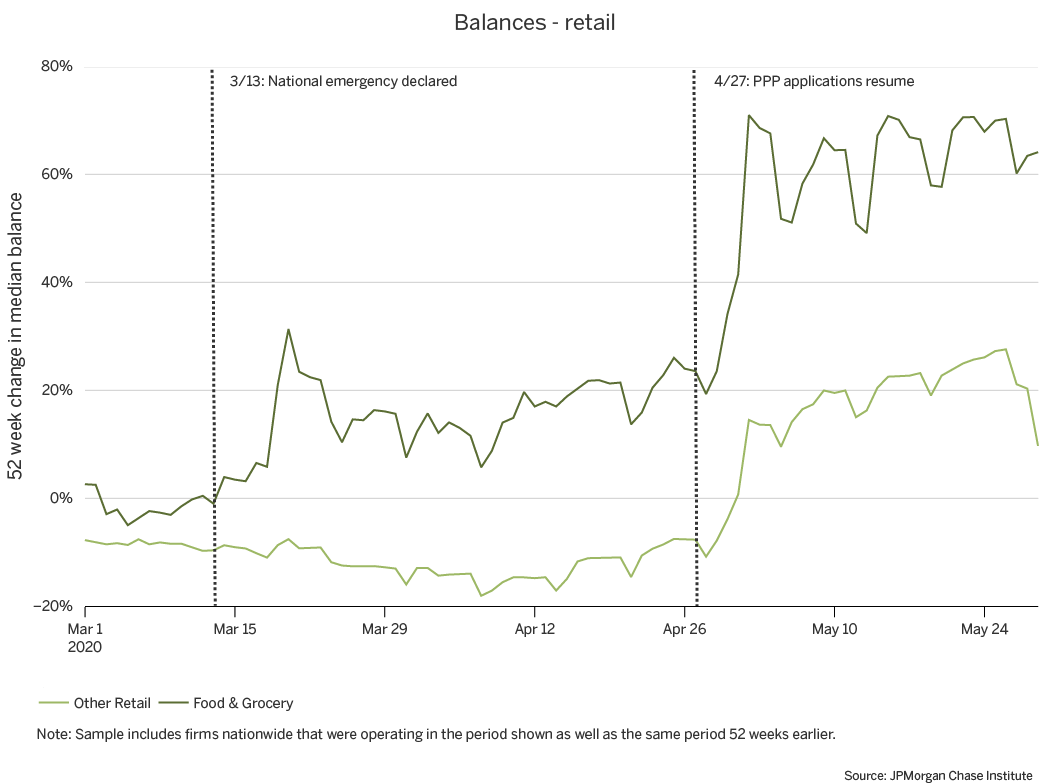

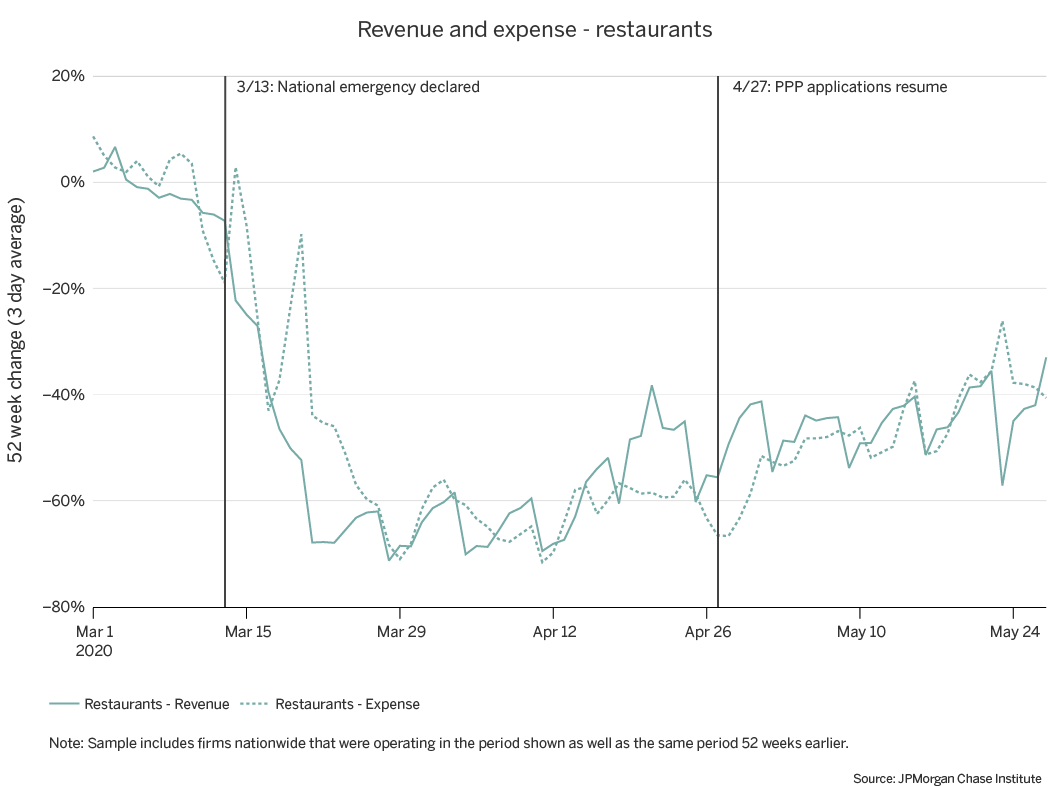

Small Business Financial Outcomes During The Covid 19 Pandemic

Research Breaks Down Covid 19 S Impact On Hotels Travel Plans Hotel Management

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Mobility Under The Covid 19 Pandemic Asymmetric Effects Across Gender And Age In Imf Working Papers Volume 2020 Issue 282 2020

Small Business Financial Outcomes During The Covid 19 Pandemic

Chenango County Real Property Tax Services Assesment And Tax Rolls

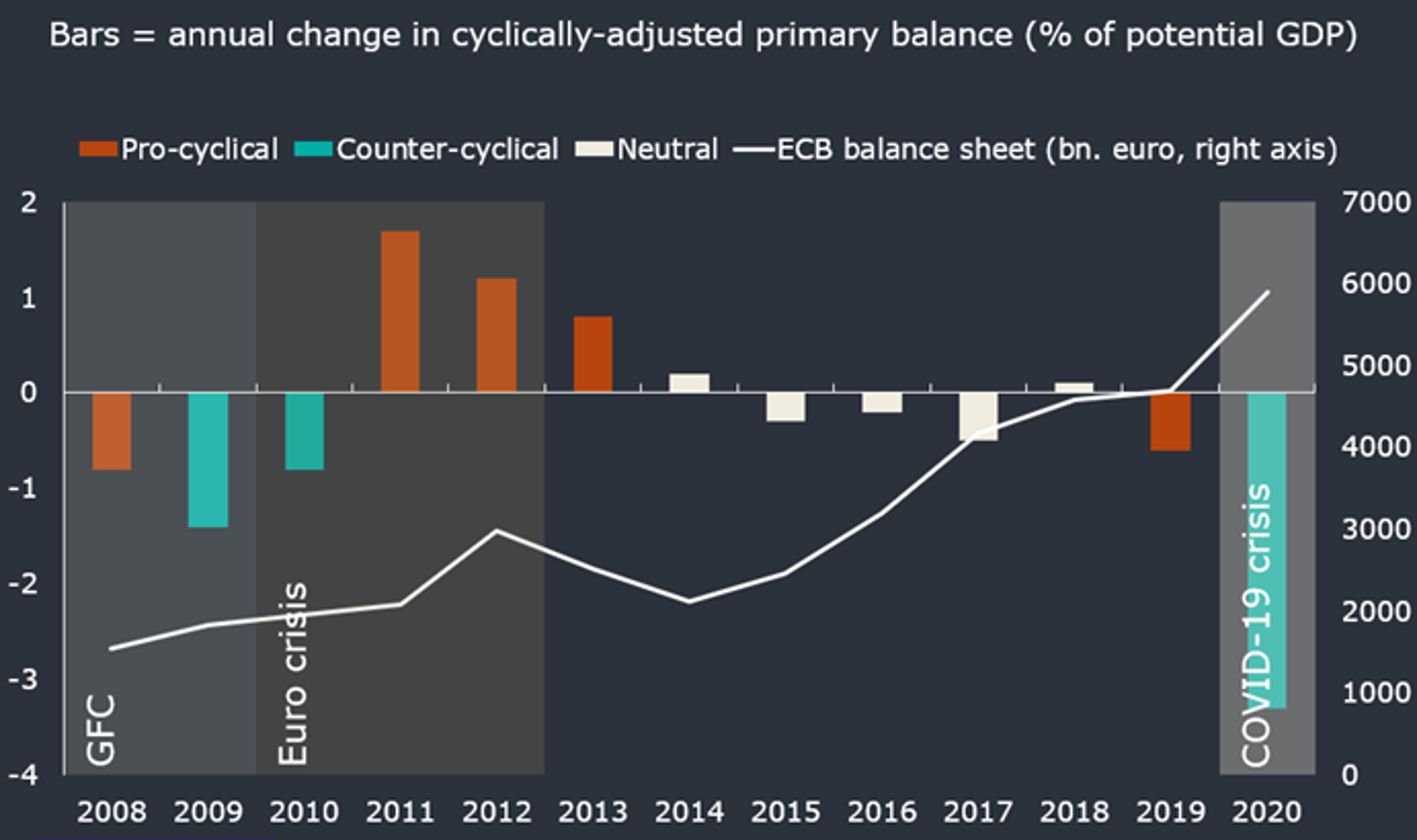

Speech Klaas Knot The Case For Fiscal Stabilization In A Low Interest Rate Environment

Mobility Under The Covid 19 Pandemic Asymmetric Effects Across Gender And Age In Imf Working Papers Volume 2020 Issue 282 2020

A Real Problem House Prices Soar Despite Coronavirus Politico

Covid 19 Protection Risks Responses Situation Report No 7 As Of 24 August 2020 Global Protection Cluster

Mobility Under The Covid 19 Pandemic Asymmetric Effects Across Gender And Age In Imf Working Papers Volume 2020 Issue 282 2020